Effective Ways to Reduce Car Insurance Renewal Cost

Is it accurate to say that you are among those individuals for whom, their autos are their most prized belonging? Anyway recharging protection consistently has turned out to be luxurious and the prospect of a higher premium gives you the chill! We should discover approaches to battle your auto protection restoration cost.

Regardless of whether it's a BMW or an Alto, what difference does it make? A second hand auto or a fresh out of the plastic new one! By one means or another we have a tendency to get possessive about them regardless of whether they shouldn't be the most costly evaluated belonging we claim. Presently a days where everything is EMI based, bearing an auto ain't whoop dee doo!

No big surprise we have such huge numbers of autos on the streets today.

For a nation like India where terrible streets and activity is as yet a torment, we ought to necessarily reestablish our auto protection with the end goal to maintain a strategic distance from immense costs if there should be an occurrence of a mischance. In the event that the issue was in our grasp, I am certain we wouldn't have selected to spend on restoring the auto protection arrangement, regardless of whether it didn't have much effect to our pockets. In any case, one good thing which the legislature has constrained is protection and we are yet not obliged about it. Since..

The most compelling motivation individuals dither to purchase protection is rising premiums. On the off chance that an auto's esteem is devaluing consistently, for what reason does the protection reestablishment premium not bring down with it? What's more, that has not been the situation for most recent couple of years. Since we have seen costs taking off as opposed to diminishing.

At first the IRDAI (Insurance Regulatory and Development Authority of India) proposed up to half increment in the outsider engine protection and later it was demonetization which cleared approach to GST. Increment in premium was likewise on the grounds that the IRDAI needed to help the insurance agencies to strike a harmony between number of cases made and the misfortune proportions of the back up plans. In any case, there are ways where you can in any case figure out how to diminish your premium to an impressive sum without significant trade off on your approach. How about we discover how?

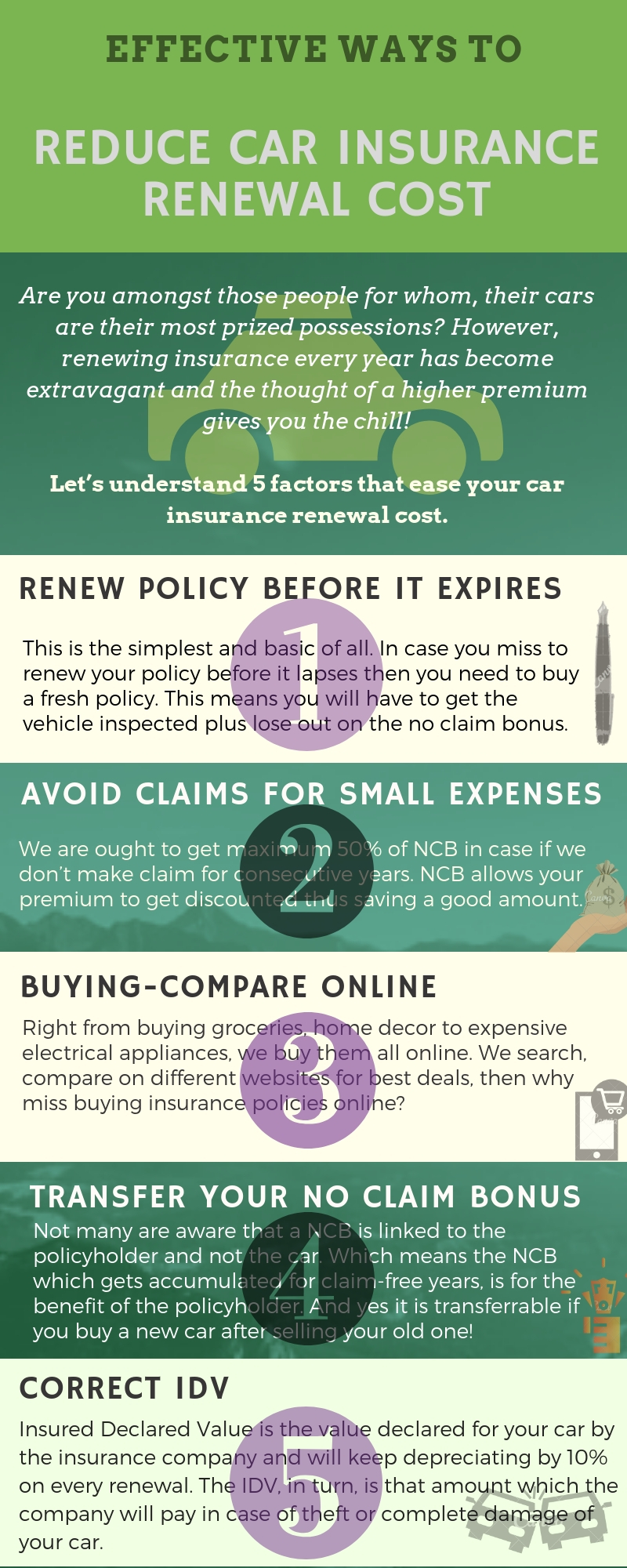

Top five different ways to lessen auto protection reestablishment cost

Reestablishing arrangement before it lapses

This is the most least complex and essential of all. On the off chance that you miss to restore your strategy before it slips by then you have to purchase a crisp approach. This implies you should get the vehicle reviewed in addition to miss out on the NCB (No case reward).

What's more, no NCB implies no markdown on your strategy. Every one of these components are sufficient for a decent increment in premium.

Abstain from making claims for little costs

We are should get most extreme half of NCB on the off chance that on the off chance that we don't make guarantee for successive years. NCB enables your premium to get reduced consequently sparing a decent sum.

For instance: Your auto gets harmed in the stopping and has a little imprint. The expense for repairing the gouge is lesser when contrasted with the NCB amassed. OK still need to relinquish the markdown by guaranteeing a unimportant sum?

Also, in the event that in the event that you happen to make a case, one year from now while restoring you may need to pay colossal sum for the premium, since you have lost the collected reward.

Along these lines, it's astute to reconsider before asserting for a little sum which can be effectively shelled from your pockets.

Purchasing and looking at premiums on the web

Appropriate from purchasing goods, home stylistic layout to costly electrical machines, we get them all on the web. We seek, think about on various sites for best arrangements, at that point why miss purchasing protection strategies on the web?

The benefit of purchasing a protection approach is that you can think about premiums of various insurance agencies and pick them on premise of surveys, prominence, premiums, guarantee settlement proportions and so forth.

In particular, the best thing about purchasing protection online is that you get them all on substantial marked down rates. Expectation these reasons are all that anyone could need for you to purchase a strategy on the web.

Exchanging your No case reward (NCB)

Relatively few know that a NCB is connected to the policyholder and not the auto. Which implies the NCB which gets aggregated for case free years, is to serve the policyholder. What's more, yes it is transferrable in the event that you purchase another auto in the wake of offering your old one!

Nonetheless, recall forget to get a NCB endorsement for your vehicle from the insurance agency, which will assist you with getting a markdown while purchasing another auto strategy. Likewise regardless of whether you are not purchasing another auto quickly, if it's not too much trouble exchange the NCB as the NCB maintenance endorsement is substantial for a long time.

Making reference to remedy IDV (Insured Declared Value) and different subtle elements

IDV is the esteem proclaimed for your auto by the insurance agency and will continue devaluing by 10% on each reestablishment. The IDV thus is that sum which the organization will pay if there should arise an occurrence of burglary or finish harm of your auto.

Notwithstanding, the greater part of us need a decent IDV and don't consider deteriorating it consistently, and that effects the premium of your auto protection approach. If it's not too much trouble make sure to make reference to the right IDV of your auto which would help in advancing your premium.

Additionally making reference to remedy data is fundamental to bring down the premiums. Points of interest like your auto fabricating year, RTO locale, making reference to past case if any effects the premium of your vehicle protection to a great deal of degree.

With these little tips I am certain recharging your auto protection arrangement won't be an assignment any longer. Furthermore, you will have a protection cover constantly. So think shrewd, act savvy!

Here are some best tips that will doubtlessly lessen your auto protection restoration cost